Favorite Info About How To Become A Financial Planner In Texas

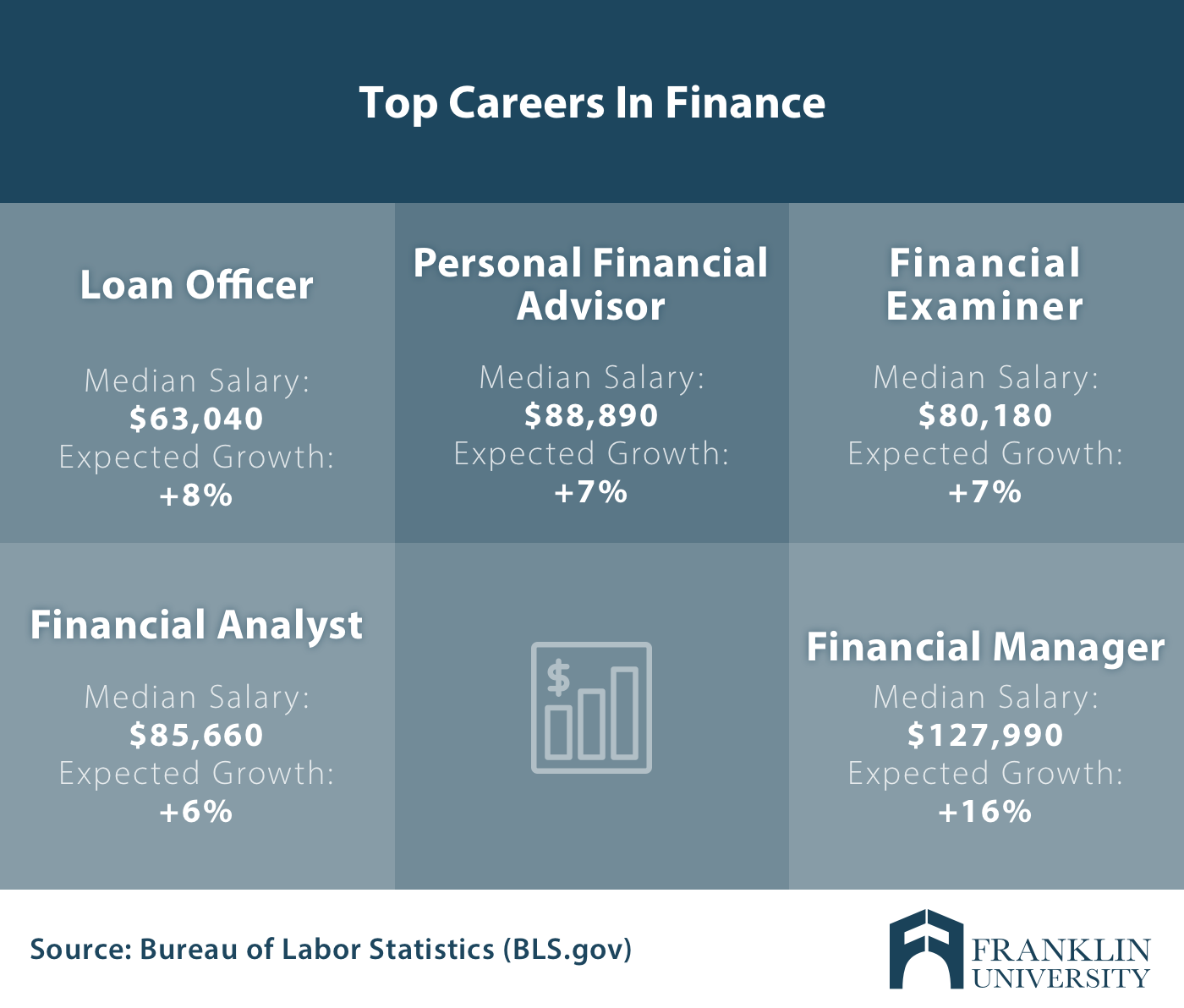

The process for becoming a financial planner varies depending on what kind of advising or planning you want to do.

How to become a financial planner in texas. Completing the education component by enrolling. Because the program is organized around key objectives outlined. The minimum educational requirement for financial planners is typically a bachelor's degree.

Getting started as a registered investment adviser. While attending texas tech university i discover a subject called financial counseling (aka behavioral finance) and i could not resist exploring the idea of learning from this subject. 4) complete either 6,000 hours of professional experience related to the financial planning process, or 4,000 hours of apprenticeship.

You need a bachelor's degree to become a financial advisor, but it doesn't need to be in a specific major. The texas state securities board requires investment adviser applicants to submit registration forms and fees electronically through the. Budget & debt management, comprehensive financial planning, attending college, 401 (k)/403.

Get a degree that prepares you with the knowledge of financial markets necessary to provide. Cpf exams are held in two sessions, each taking three hours to complete. 3) pass the cfp exam;

By pursuing a finance degree program and sitting for the industry exam, you can become a certified financial planner™, or cfp® professional, and help clients achieve. To become a cfp, you must complete a rigorous certification process that requires passing challenging exams. Certified financial planner ( cfp ).

To become a certified financial planner tm, you are required to meet the four e’s: Commission and fee financial advisor serving texas. The texas state securities board has no established educational requirements for becoming a stockbroker, but many.

![How To Become A Financial Planner [Certifications, Courses & License Requirements]](https://www.accounting.com/app/uploads/2020/08/GettyImages-1265038912.jpg)